From strategy development all the way through to field-level research

We deliver value for our clients by weaving our capabilities for specific corporate functions across all our services.

Showcase of our capabilities

Macro & megatrends

Megatrends are macroeconomic and geostrategic forces that are shaping our world. We help clients understand these powerful changes and what they mean for their business models.

Strategy analysis

Disruptive technologies have a transformative impact on the way we work, think and live. We work with clients to develop a strategy that demonstrates values and is fit for the future.

ESG

Environmental, social and governance (ESG) factors are increasingly influencing boardroom decisions. We focus on one question: how we create values from ESG activities?

Data & analytics

We provide our clients accurate, up-to-date and relevant data to enable decision-making through data analysis, modelling, and visualisation.

Human capital planning

We design human capital plans and implementation strategies to improve employee efficiency during business as usual and change processes.

Learning & development

We developed our own analytical framework for evaluating and identifying the L&D needs of client organisations and help them develop a cohesive training programme.

How to capitalise on megatrends

Using megatrends to anticipate long-term shifts in society

Our megatrends expertise helps senior leaders and market intelligence managers identify relevant trends, monitor potential environmental, societal and technological changes, and become more resilient long-term.

We develop forward-looking scenarios to enable clients to stay ahead of potential events. Imagining the future through scenarios helps our clients to test the robustness of their strategic choices in the face of external trends.

Lessons from emerging markets: doing more with less

The economic and political influence of the largest emerging economies will continue to increase as newly affluent consumers will expand across emerging markets driving global demand for manufactured goods and services.

Coping with poor infrastructure and difficult business environment due to bureaucracy and legal uncertainties, businesses in emerging markets have learned to focus on deploying their limited resources and maximising the impact.

Finding clever ways to overcome resource limitations is a key capability in developing a viable strategy in the era of ESG and growing uncertainties.

Maris Strategies analysis

Disruptive technologies for financial services organisations: risk or opportunity?

Disruptive technologies such as Artificial Intelligence (AI), Distributed Ledger Technology (DLT) and Internet of Things (IoTs) present financial services institutions with both risks and opportunities. Leaders must have the right resources to move their organisations forward in the era of digital disruption.

A new dawn in trade finance: capitalising on disruptive change

Widespread adoption of blockchain (DLT) technology in trade finance could reduce friction and cost, which will boost speed and increase the transparency of cross-border transactions. Cross-border payments and remittances are expected to be the most disrupted area of banking practices.

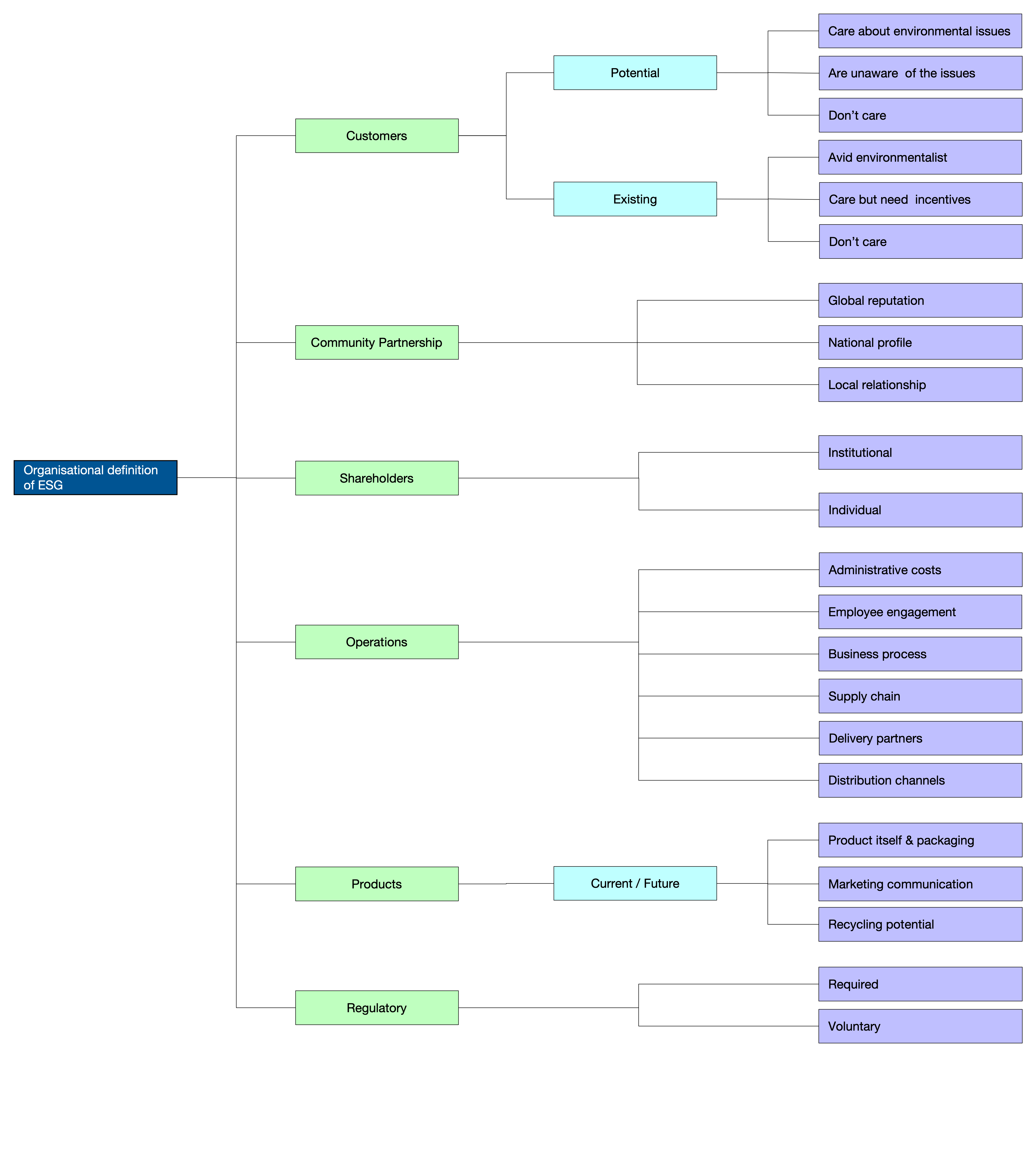

Our ESG focus

Clearly defining the ESG value propositions

For many organizations, the definition of ESG is vague due to a lack of structural designation.

The key is clarity. The structure presented here is an approach to illustrate what senior managers should consider when defining an ESG agenda.

Our ESG work is not focused on a box-ticking exercise or a publicity campaign but developing a clearly defined strategy creating long-term values.

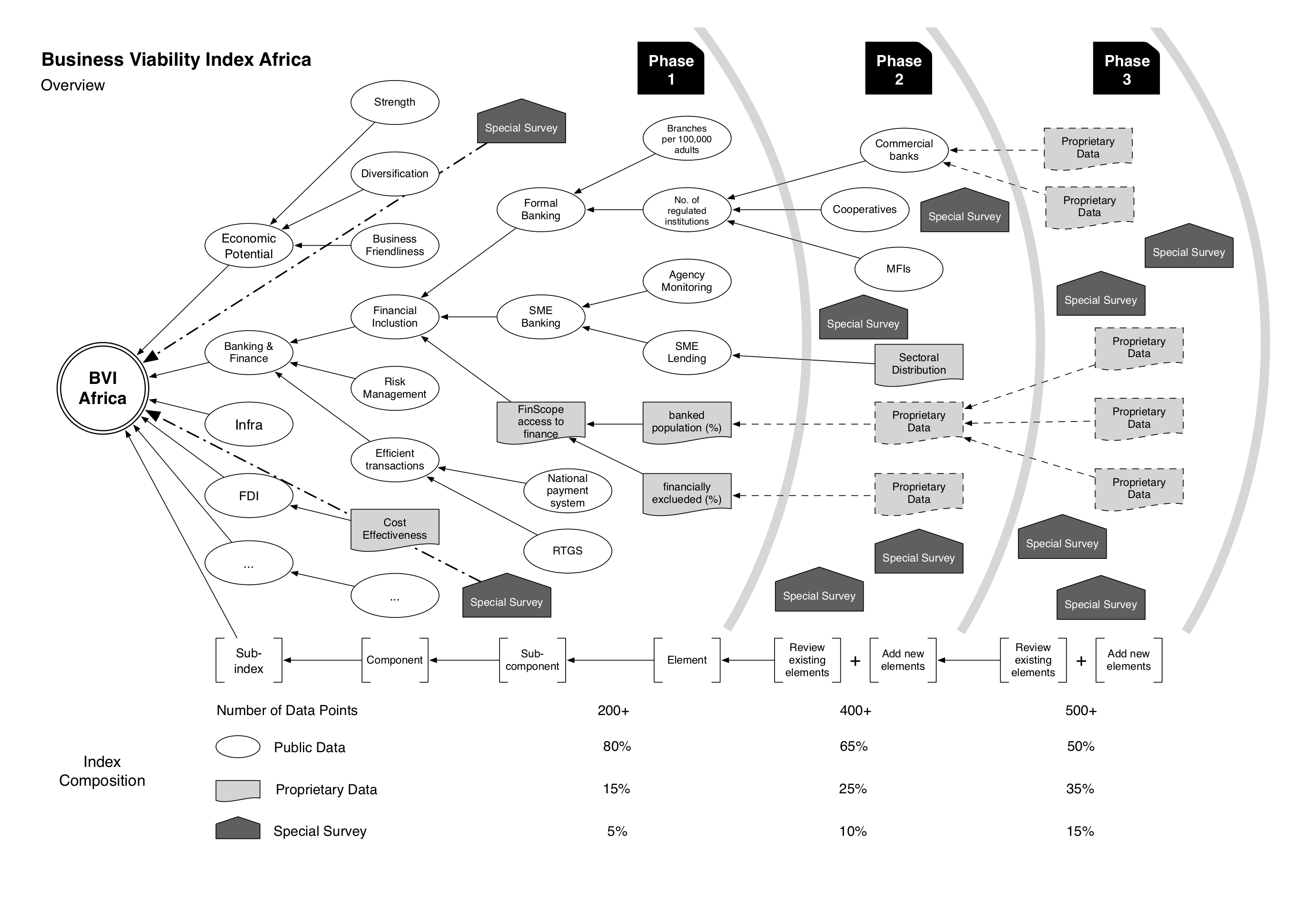

Our analytical approach

Data & analytics

We have delivered strategic advisory and technical support for clients in the development of data-driven research and database development projects focusing on aggregating verified, cross-referenced and standardised data from various sources.

Understanding the Islamic banking value positions

Since 2006, we have been working with the Banker (a Financial Times publication) and provided data research and analysis for the Top Islamic Financial Institutions ranking, the definitive benchmark for the rapidly evolving industry.

Designing a macroeconomic data platform for global financial professionals

We have advised clients on the most viable approach to design and develop a digital data platform designed to aggregate verified, cross-referenced and standardised data from leading global institutions, governments and NGOs.

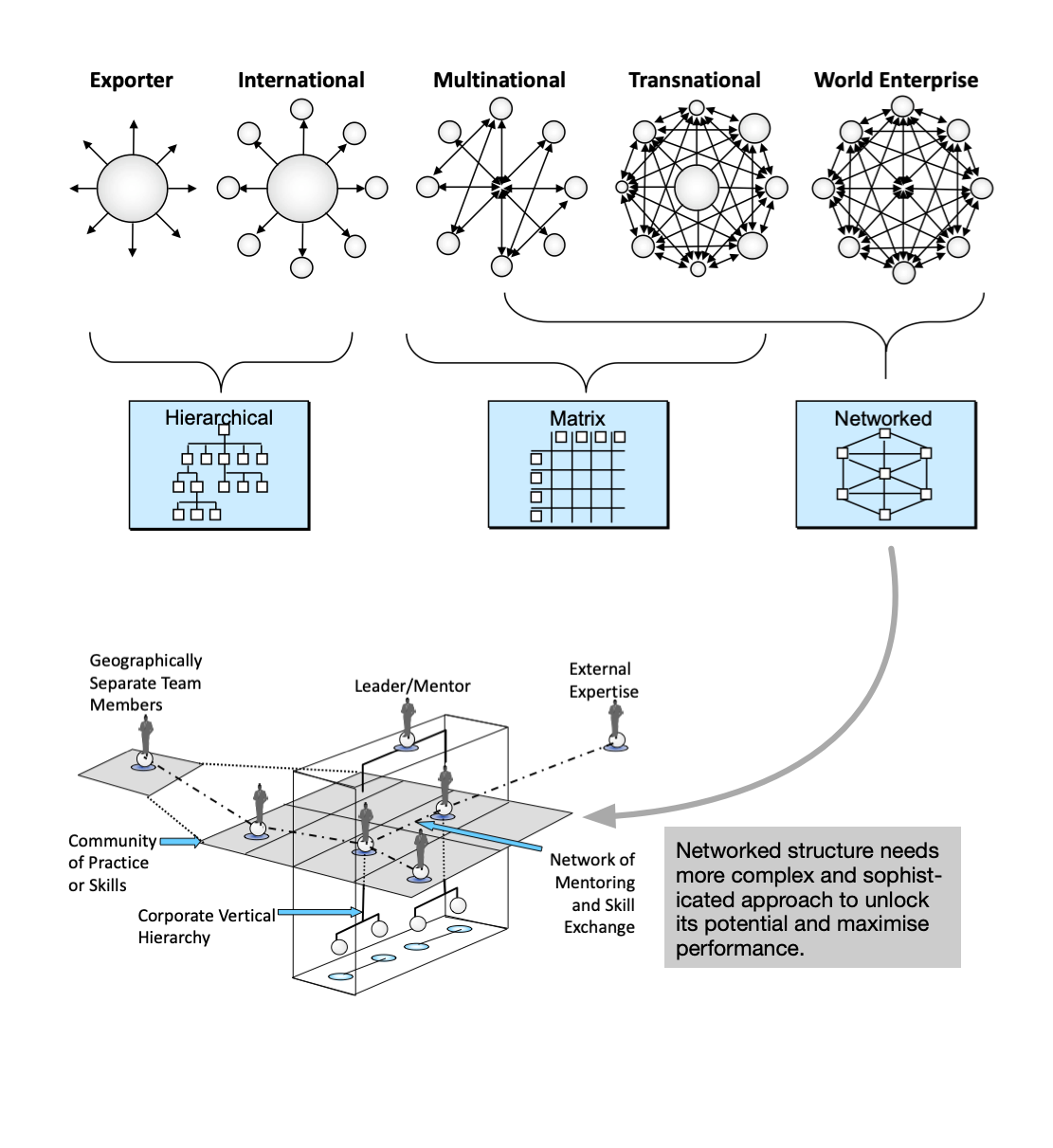

We see organisational competencies as a network

Building and maintaining the right level and mix of human resources is a constant challenge: organisations evolve from one stage to the next as their businesses grow, and they are going to deal with increasingly more complex business transactions and address new challenges.

We help organisations to align their employees with organisational objectives and strategy in a timely and efficient manner.

Customised interactive learning experience

Simulating the business reality

Interactive learning enables executives to learn new concepts and build new capabilities more efficiently. We have developed a learning platform that creates a dynamic environment for next-gen leaders to learn fundamental knowledge of business and experience the impact of their strategic decisions.

A learning journey designed for ambitious GCC banks committed to aligning their strategic goals with their countries' national vision

We have designed and delivered executive education programmes for senior executives and rising stars at the leading regional financial services institutions with global ambitions.

Our Publications

Our Managing Director Joseph A. DiVanna and Senior Researcher C.D. Jay Jung have published numerous books and reports. These publications illustrate our ability to generate fresh insights, think creatively and provide a new perspective on conventional business concepts and practices.